There are two categories that different types of loans fall under; Secured or Unsecured. Unsecured loans are the most popular type of loan. These are also referred to as signature loans because the borrower’s signature signifies their agreement to repay the loan. Secured loans are ones that require the borrower to provide some form of collateral in order to secure the loan. If the borrower defaults on their loan then the lender has the ability to take possession of the collateral. Both types of loans have their own advantages and disadvantages. Your individual circumstances will affect which type of loan will work best for you.

If you meet the requirements you could get a loan!

Fill the form below to get a QUOTE!

Need cash in a hurry? You get cash the same day!

And you keep your vehicle!

Interest Rates

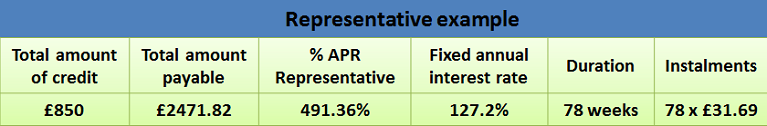

One advantage that secured loans have over unsecured ones is that they will generally offer lower interest rates. Since there is collateral involved there is more motivation for the borrower to repay the loan. The interest rate you get on your unsecured loan will rely heavily on your credit and income amongst other factors. Secured loans rely more on the type of security being used.

Loan Amounts

The amount of money that you get from a secured loan is usually based on the value your collateral. If you’re using a £2,000 necklace as collateral, it’s unlikely that you would be approved for more than £1,500 at the very most. With unsecured loans, the amount you’re approved for will depend on what the loan is for, how much you make, and your credit. Banks will question you on what you’re seeking the loan for and might not approve you for the full amount you’re seeking. For people with good credit and steady income, you will usually be able to get approved for high amounts.

Credit – subject to eligibility and affordability

Your credit will play a big role in which type of loan you seek. Secured loans are favored by people with bad credit. With options such as logbook loans, you can get approved for a significant amount of money even with bad credit. With unsecured loans, it’s very unlikely that you’ll get approved for personal loans from a bank. The other option would be to seek a payday loan which will cost you a lot in interest and fees if you’re late on payments. If your credit isn’t great it’s probably better to seek a logbook loan.