Logbook loans are innovations in the lending industry that make it possible for borrowers to acquire loans that are considerably larger than those they might get by visiting a payday loan agency. These loans are available both to clients who could otherwise request payday loans and also to clients who are prevented from doing so for a variety of reasons. Payday loans have been around for many years and the industry has expanded considerably since the most recent onset of financial troubles around the world. Logbook loans are the most recent adaptation of the lending industry to ever-changing circumstances in the economy.

If you have bad credit and are in need of a loan, you most likely considered applying for a payday loan. Due to their popularity and wide availability, people with bad credit often think this is their only option. However, logbook loans are often times a better option but they are usually overlooked. Before you make the decision to take out a payday loan, we urge you to read this information on payday loans vs. logbook loans.

If you meet the requirements you could get a loan!

Fill the form below to get a QUOTE!

Need cash in a hurry? You get cash the same day!

And you keep your vehicle!

Interest Rates

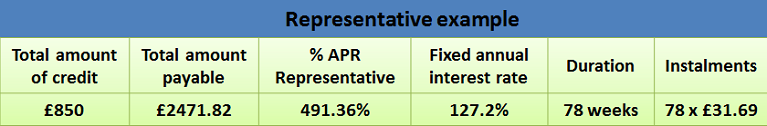

The first area you should look into before you decide which type of loan you want is the interest rate. Payday loans have notoriously high interest rates, and are very controversial. While logbook loans have higher interest rates than traditional loans, they are usually much less than that of payday loans. This is because payday loans are unsecured so the lender is taking more of a risk when approving applicants. On the flip side, logbook loans are secured by a vehicle so the lender feels they have more recourse in the unlikely event that you default on the loan.

How much do you need?

Another factor you should consider when deciding if you need a payday loan or logbook loan is how much you’re seeking? Are you just seeking a few pounds or do you need a more substantial amount? Most lenders in the U.K. only allow you to be approved for around £1,000 at the most, so if this is not going to be enough for your needs, it’s usually better to consider a logbook loan which can be approved for £250 – £50,000 depending on the value of the vehicle being offered as collateral and on how much you can afford.

When can you repay the loan?

The loan terms for logbook loans are generally for much longer than payday loans. The purpose of a payday loan is to repay the borrowed amount on your next pay day, and after that you start accruing further fees and interest. Logbook loans offer you the ability to repay the loan over an extended period of time if necessary. Because of this, logbook loans are much more flexible than payday loans.

Repercussions of Defaulting

As mentioned earlier, payday loans have extremely high interest rates. So in the event that you are unable to repay the loan on your next pay day, you can expect a significantly higher amount than the original amount. And the longer you’re unable to pay back the loan, the more debt you build.

Conclusion

Take all of these factors into consideration when seeking a bad credit loan. While payday loans may be popular, realize that logbook loans are usually a more viable option. If you’re interested in a logbook loan, simply fill out our web form to get the money you need.