A logbook loan is a loan advanced with your vehicle being used as collateral on the loan. The amount of money advanced depends on the value of the vehicle and your ability to pay the loan. If you had used the vehicle earlier to borrow some money, you can only borrow some more if the sum amount of the cash you had borrowed and what you intend to borrow is less the half of the net value of the car. Some lenders would not agree a vehicle refinance.

If you meet the requirements you could get a loan!

Fill the form below to get a QUOTE!

Need cash in a hurry? You get cash the same day!

And you keep your vehicle!

How logbook loans work

There are several logbook loan lenders on the Internet. It is good to a little shopping around for good loan terms, competitive interest rates, and high loan amounts. The selected lender must meet with you for the vehicle valuation. If he agrees to lend you the money, he will take your logbook as security until you have serviced the loan. The logbook is the proof that you own the vehicle. Most of the logbook loans are only up to half of the vehicle’s net worth.

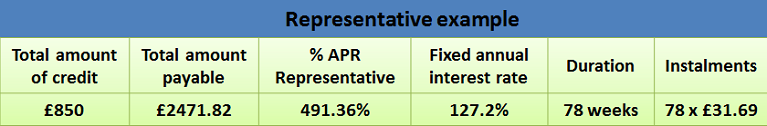

You will then agree on the loan schedule whether monthly or weekly. A typical logbook loan can be repaid between a month and up to two years. It is important to pick a loan amount that you can repay comfortably. If you are unable to pay the amount, you risk having your car repossessed or a hefty penalty added to your repayment amounts. However, your car may not be sold for just one late repayment, but if you fail to honor several repayments, the lenders may have no choice but seize your car.

Taking logbook loans all over UK

When taking logbook loans in Chesterfield UK, Wales and Northern Ireland, you are also required to sign a bill of sale agreement along with a signed agreement. This gives the lender temporary ownership of your vehicle but also allows you to use the vehicle as long as you repay the installments on time.

The lender must register the bill of sale at the high court for it to be recognized by the law. If the bill of sale is not registered, a court approval is sought before your car is repossessed.

Important information on logbook loans

Some lenders levy extra charges if you repay more the 8000 pounds in a year. Ask the lender if this is part of the loan terms. Some logbook loan lenders do not have the Direct Debit service making it hard to keep track of your repayments and amount owed. If this is your case, ask for a periodic statement of account to know the status of your loan.

If you are not able to repay the loan and the car is paid for less than you owe the logbook company, you will be expected to furnish the shortfall. The lender may seek legal assistance to force you to pay the balance. Fill out our application and we will connect you with a reputable logbook loans vendor, get a free quote now!